Personal Assets And Liabilities Worksheet Excel Excel Templates

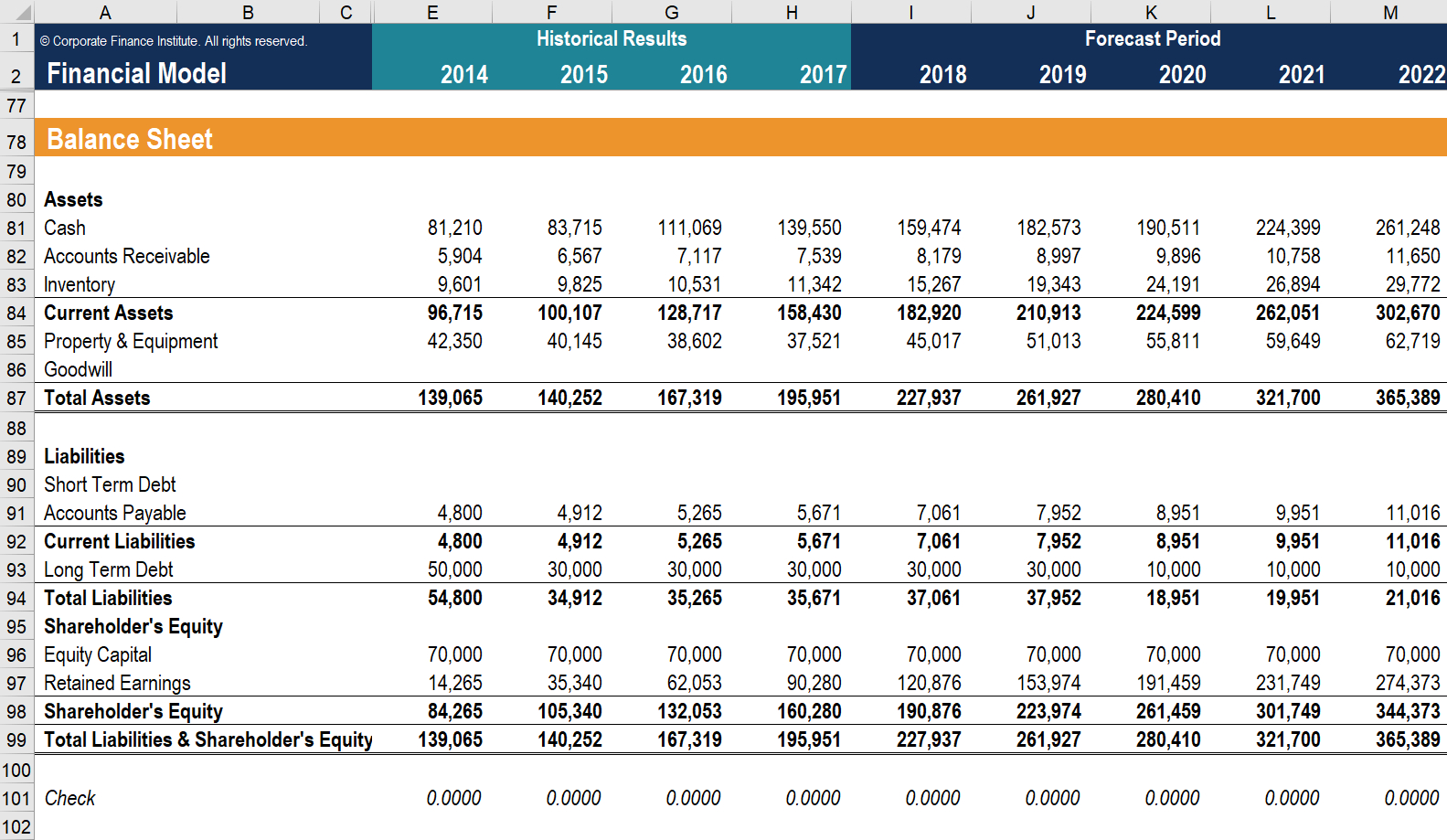

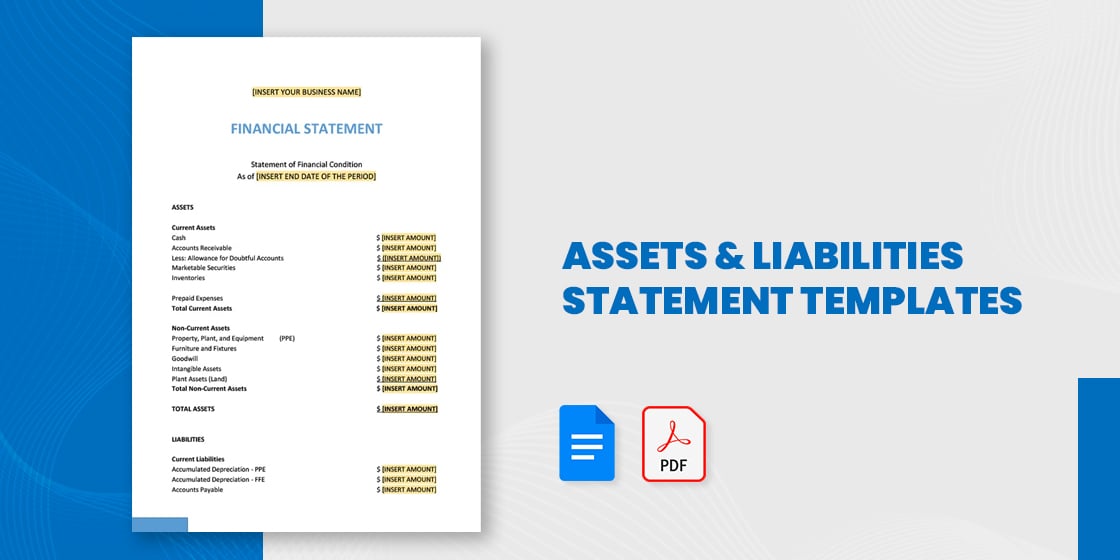

The balance sheet is based on the fundamental equation: Assets = Liabilities + Equity. Using this template, you can add and remove line items under each of the buckets according to the business: current assets, long-term assets, current liabilities, long-term liabilities, and equity.

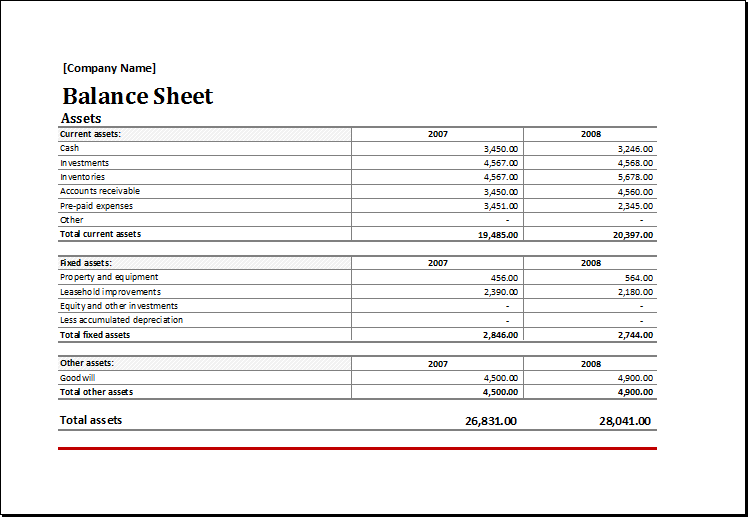

Asset and Liability Report Balance Sheet for EXCEL Excel Templates

Get free Smartsheet templates. We've compiled free, printable, customizable balance sheet templates for project managers, analysts, executives, regulators, and investors. Use these balance sheet templates as financial statements to keep tabs on your assets (what you own) and liabilities (what you owe) to determine your equity.

Assets And Liabilities Spreadsheet Template —

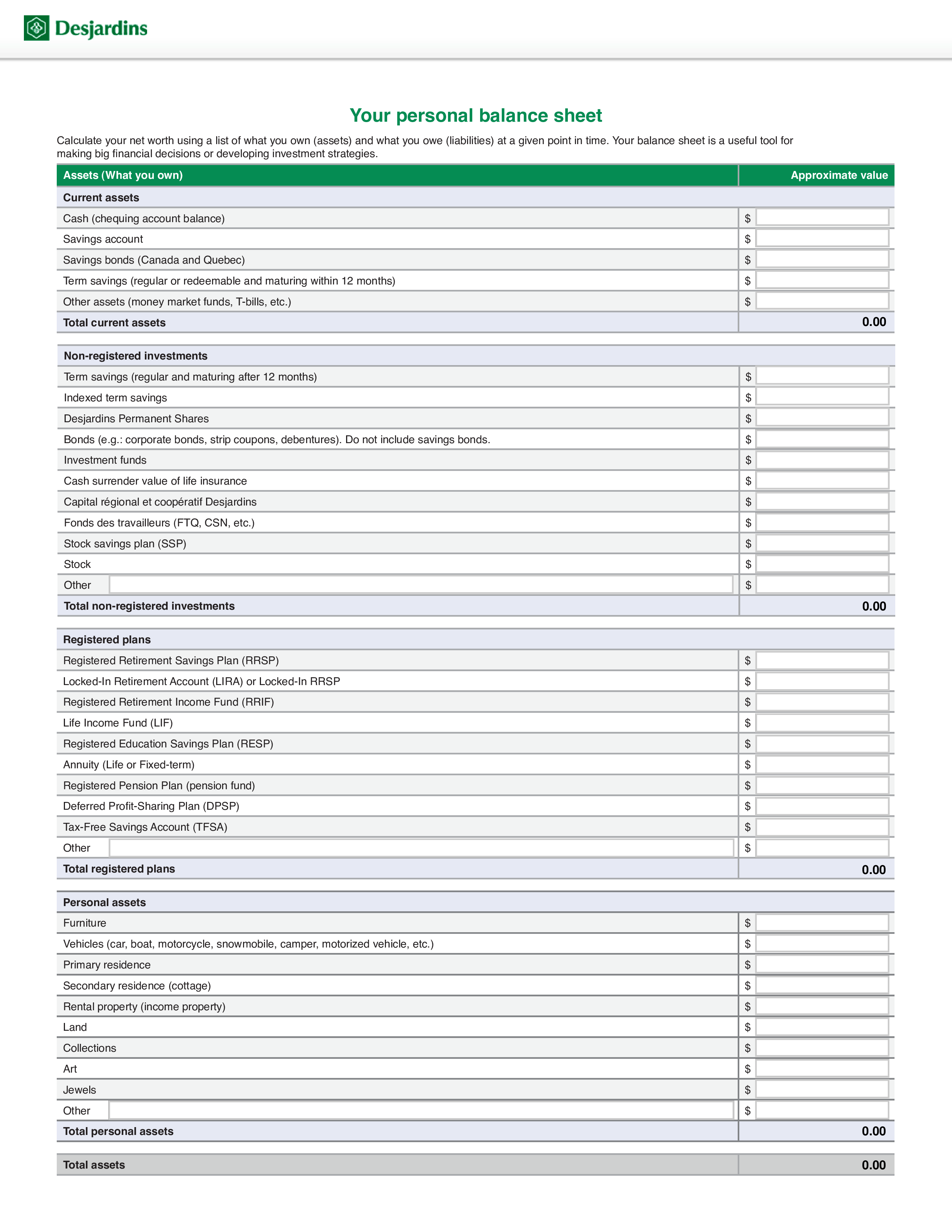

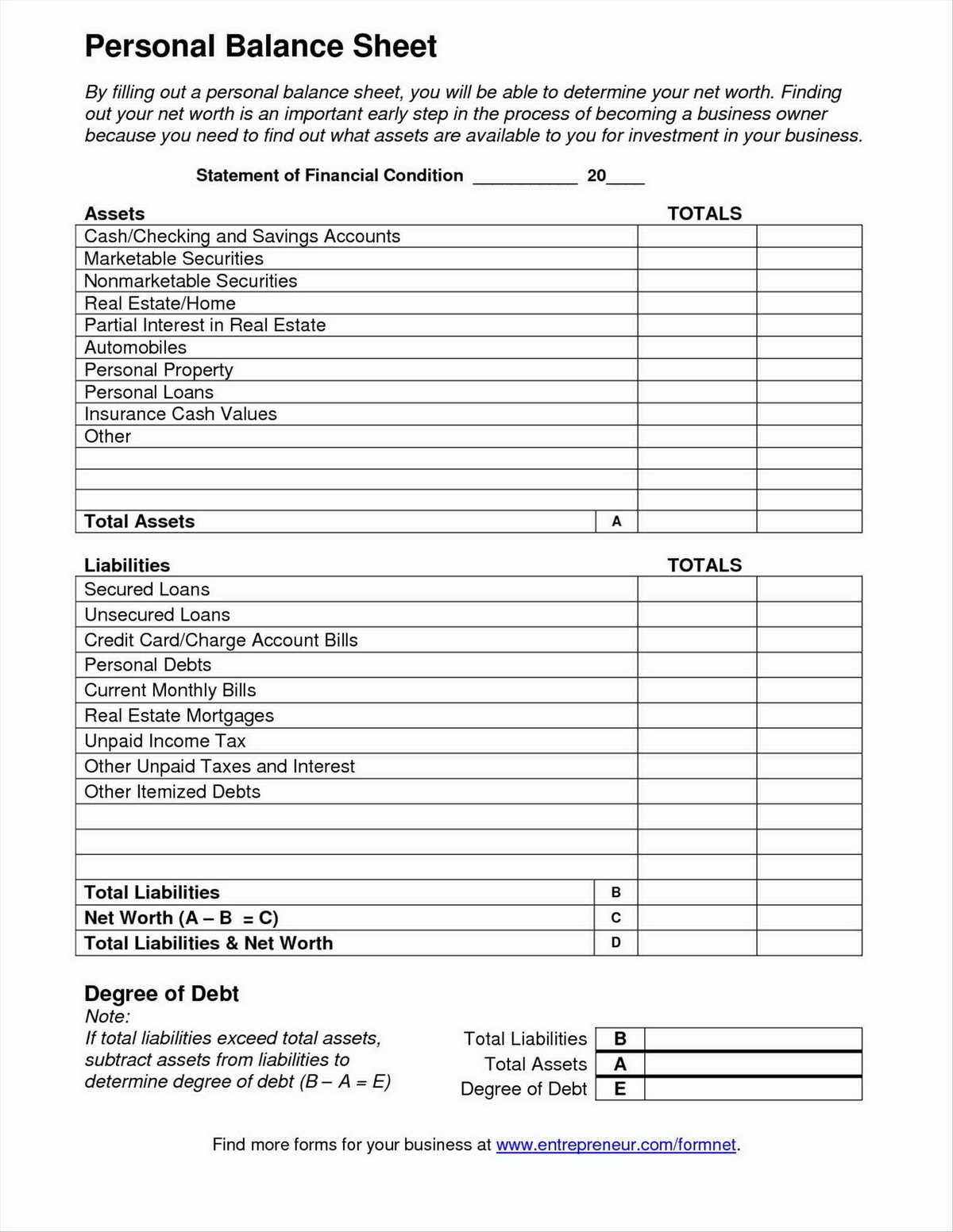

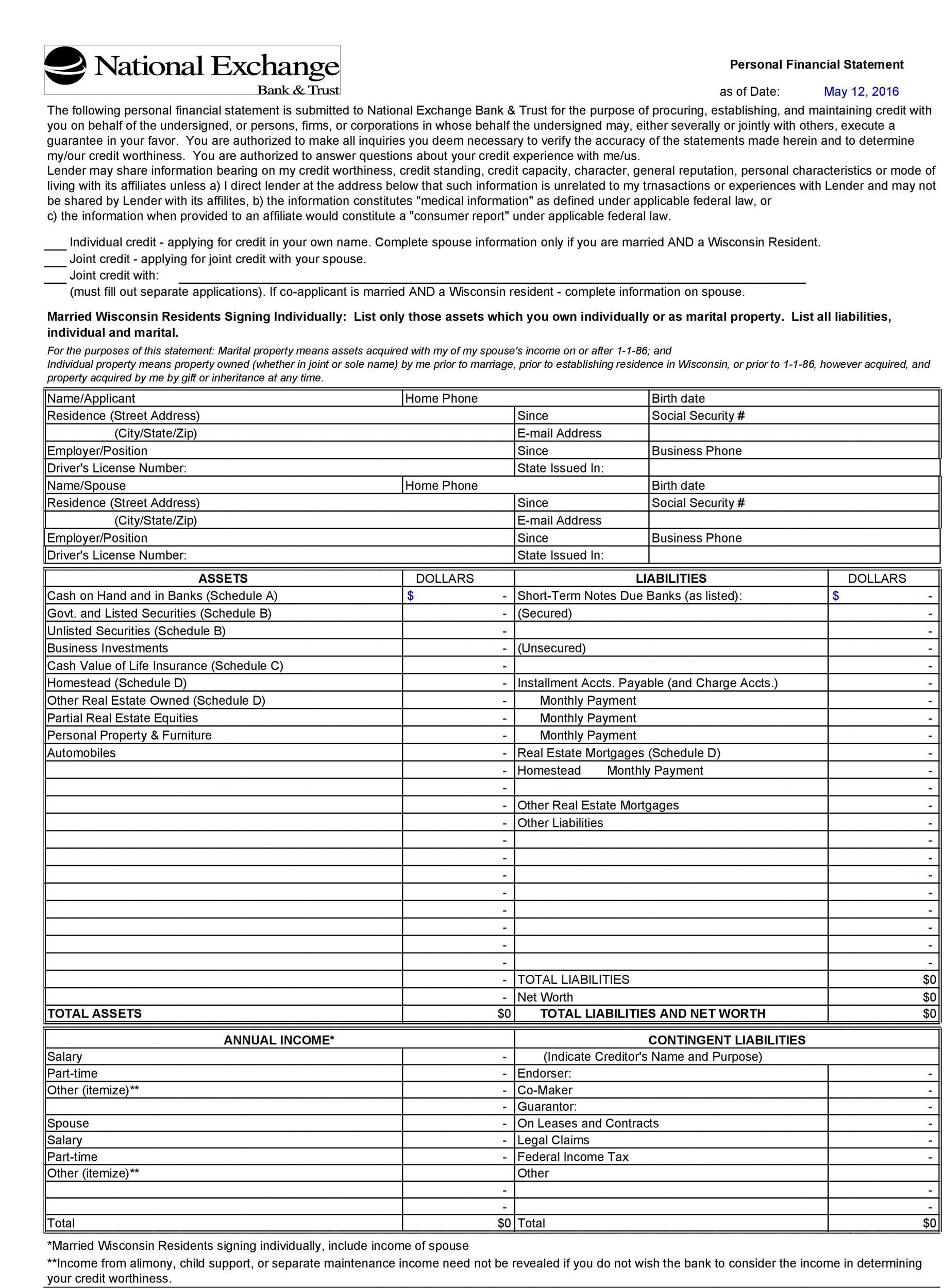

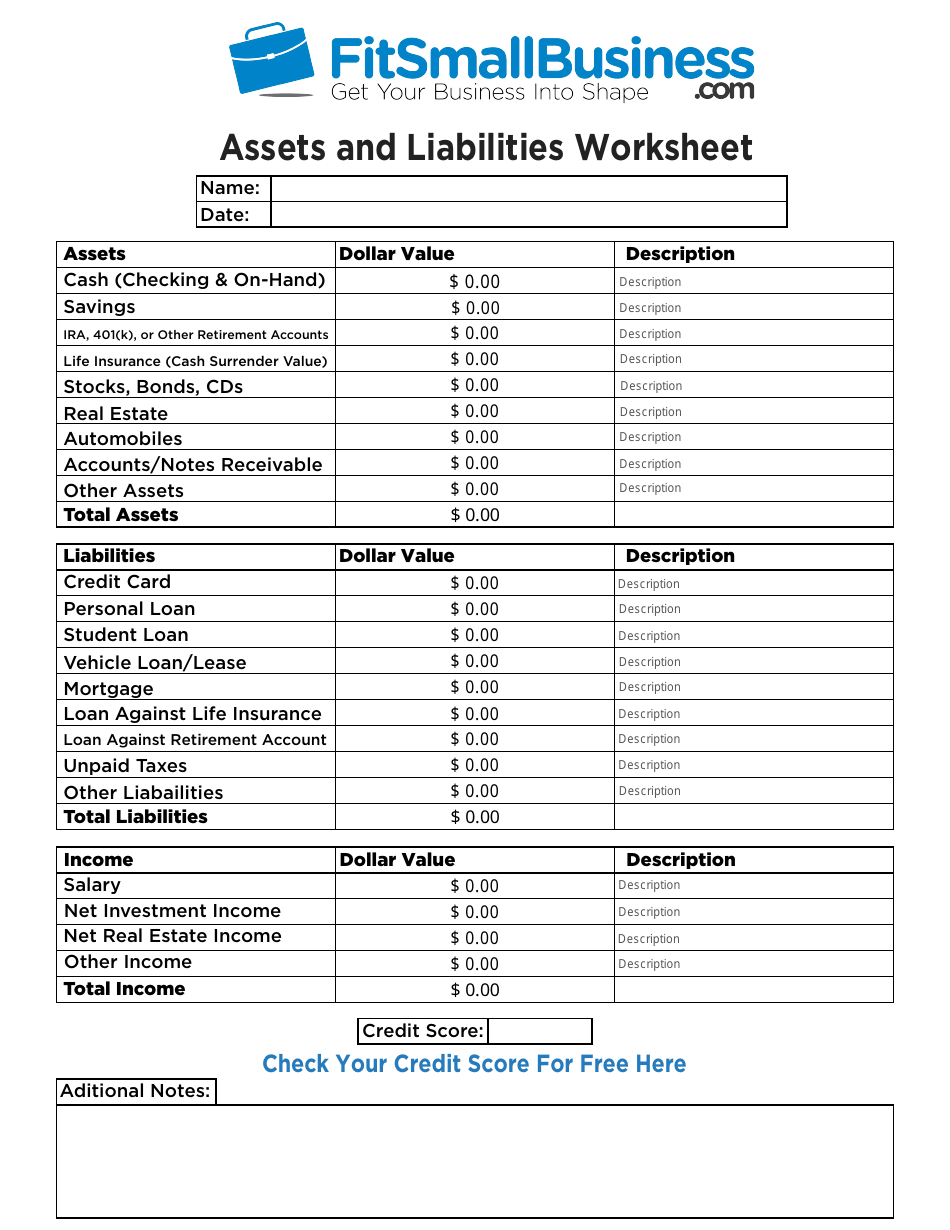

A personal financial statement, or PFS, is a document or set of documents that outlines a person or family's financial position. The balance sheet portion of a PFS exhibits your assets and liabilities, or net worth. Some people create more detailed personal financial statements, including an income statement or other documents.

Personal Balance Sheet example Templates at

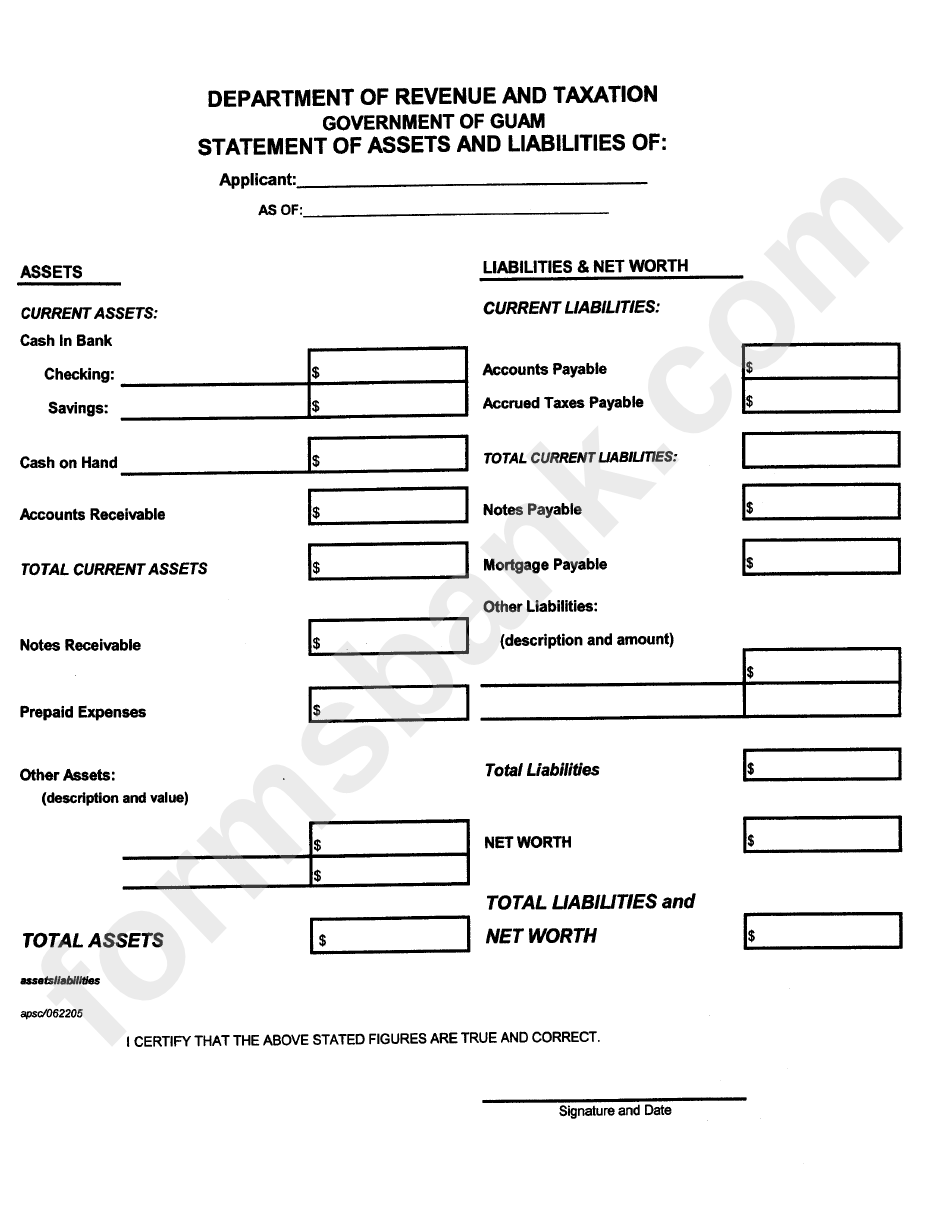

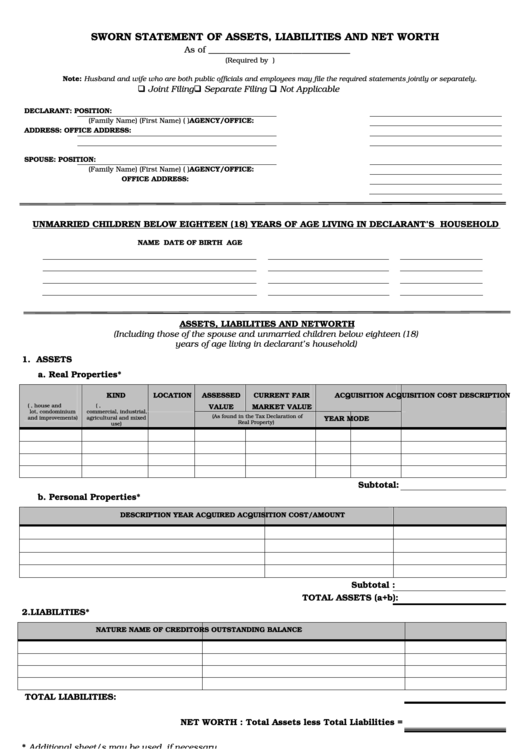

I. Statement of Assets and Liabilities A. Assets . List all assets owned by you, your spouse, or any other member of your household, directly or. document supporting your estimate of the asset's value. 2. For each liability, indicate the date incurred, the original amount of the liability, the length of the obligation, the interest rate.

Statement of Assets and Liabilities Form Mergers And Acquisitions Net Worth

The Sworn Statement of Assets, Liabilities, and Net Worth is a document used to disclose an individual's financial standing. It is often required for public officials or government employees to ensure transparency and avoid conflicts of interest. It helps monitor their financial activities and detect any potential discrepancies.

Statement Of Assets And Liabilities Form printable pdf download

Use this monthly or quarterly small business balance sheet template to analyze and archive your business's assets, liabilities, and equities over monthly, quarterly, and year-to-date timelines. The spreadsheet will automatically calculate short term and long-term assets and liabilities every quarter and at the end of each year.

Top Assets And Liabilities Spreadsheet Templates free to download in PDF format

Liabilities Assets Mortgages to: Real Estate Address $ $ $ $ $ $ $ $ Bank overdraft (Personal business) $ Bank/cash Investments. I/we, the undersigned, do hereby certify that the above is a full and true statement of my / our assets and liabilities as at / / . Name Name Signature Signature . Author: RajD Created Date: 12/22/2014 2:06:32 PM.

Best Statement Of Assets And Liabilities Format For Llp Balance Sheet Proforma

1. Financial Assets & Liabilities Statement Template 2. Personal Assets and Liabilities Statement Template 3. Client Assets and Liabilities Statement Example 4. Assets and Liabilities Statement Form 5. Financial Assets and Liabilities Statement Format 6. Assets and Liabilities Statement in PDF 7. Sample Assets and Liabilities Statement 8.

Assets And Liabilities Spreadsheet Template Spreadsheet Downloa assets and liabilities worksheet

A balance sheet, or "statement of financial position" - This lists your assets and liabilities and calculates your "net worth" by subtracting the number of your liabilities from the number of your assets. For example, if you have $100,000 in assets and $65,000 worth of liabilities, your net worth would be $35,000.

Are your financially healthy to invest? Make Your Own Financial Plan! Smart Pinoy Investor

Template automatically calculates the Net worth statement by calculating the difference between the Total Assets and the Total Liabilities. Whenever any financial institute asks for your net worth statement simply print the page and sign it under before dispatching the statement to the concerned department. By signing we pledge that the data of.

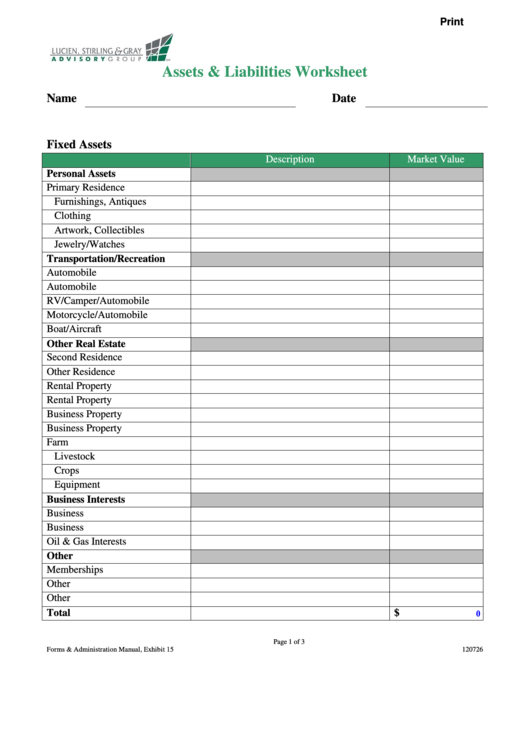

Assets And Liabilities Worksheet

Statement of Assets and Liabilities Case # Petitioner Respondent DESCRIPTION OF PETITIONER RESPONDENT COURT ASSETS Name: Name: Real Property (address) Vehicles (car, truck, boat, ATV, etc.) Bank Accounts (bank, type, & name on the account) Cash on Hand Furniture/Appliances Personal Property (by type) Claimed Value

14+ Assets & Liabilities Statement Templates in DOC PDF

Statement of Assets and Liabilities. Earnings after tax: Cash: Institution held: Monthly income (per month) Assets £ Details Partner's earnings after tax: Shares: Company/if listed: Other (investments, etc.): Life policy surrender value: Company/maturity date: Other: Personal dwelling/home: Owners/address: Other: Other property 1: Owners.

Personal Asset and Liability Statement Template

It can also be referred to as a statement of net worth or a statement of financial position. The balance sheet is based on the fundamental equation: Assets = Liabilities + Equity. Image: CFI's Financial Analysis Course As such, the balance sheet is divided into two sides (or sections).

Personal Assets And Liabilities Statement Template Collection

Statement of Assets and Liabilities (SALN) Form (Revised January 2015) | Commission on Audit Statement of Assets and Liabilities (SALN) Form (Revised January 2015) 2015 SALN Form - Additional Sheet (s) Guidelines in the Filling Out of the SALN Form File size: 93.50 KB Created: August 7, 2015 Hits: 157264 Download

Assets and Liabilities Worksheet Template Download Fillable PDF Templateroller

Description. This spreadsheet allows you to create and update an all-in-one personal financial statement that includes: Personal Balance Sheet - for listing assets and liabilities and calculating net worth.; Cash Flow Statement - for listing all your inflows and outflows and calculating your net cash flow.; Details Worksheet - for listing individual account balances and the details for your.

Sworn Statement Of Assets Liabilities And Net Worth printable pdf download

A personal financial statement is a snapshot of your personal financial position at a specific point in time. It lists your assets (what you own), your liabilities (what you owe), and your net worth. To get your net worth, subtract liabilities from assets.